The Association of Chartered Certified Accountants

The world’s most forward-thinking professional accountancy body, providing globally recognized qualifications and advancing standards in accountancy worldwide since 1904.

The ACCA qualifications are the gold standard in accountancy, opening doors to highly respected, interesting work in any sector. The professional ACCA Qualification has been officially benchmarked to Master’s level.

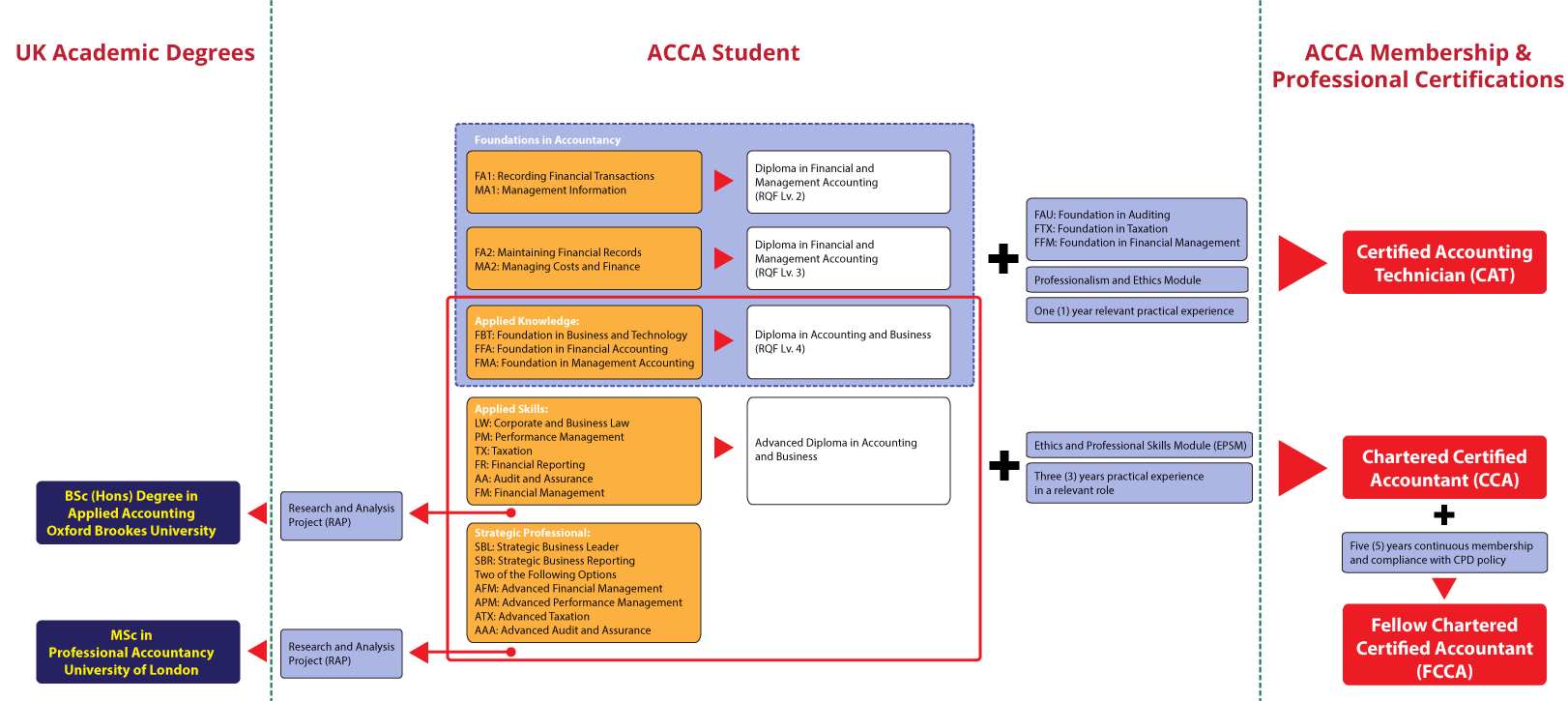

A Series of Professional Certifications and Degrees

AT REASONABLE FEES

Certified Accounting Technician

(CAT ACCA)

The CAT Qualification and ACCA Diploma in Accounting and Business (RQF Level 4) offer a route into the ACCA Qualification, providing you with a development path for employees with high potential.

Foundation in Accountancy

(FIA)

Designed for people who are just starting out on their business education journeys, FIA is the ideal way to gain an understanding of how business finance works and to open up new career possibilities – both in finance and beyond.

If you are working in or interested in a finance-related role, FIA will give you the technical knowledge you need to perform your role and advance your career. It will also give you a head start towards further finance and accounting qualifications, including the prestigious and globally recognised ACCA Qualification.

Diploma in Financial and Management Accounting

(DipFMA. RQF Lv. 2)

Consists of two (2) modules:

- FA1 Recording Financial Transactions

- MA1 Management Information

Diploma in Financial and Management Accounting

(DipFMA. RQF Lv. 3)

Consists of two (2) modules:

- FA2 Maintaining Financial Records

- MA2 Managing Costs and Finance

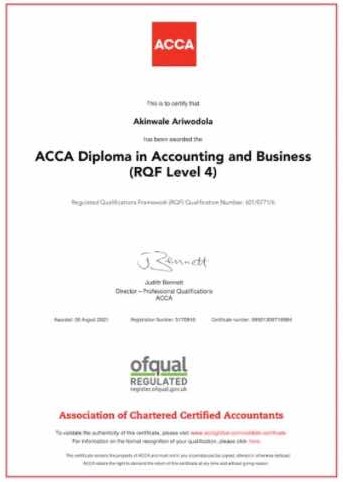

Diploma in Accounting and Business

(DAB. RQF Lv. 4)

This diploma, with UK RQF Level 4, is awarded upon completion of the Applied Knowledge exams comprising of three parts — Business and Technology; Financial Accounting; and Management Accounting — which gives you a broad understanding of essential accounting techniques.

Certificate in Advanced CAT Studies

To complete the requirements and be eligible for the Certified Accounting Technician (CAT) qualification, the following additional modules must be completed:

- Foundations in Audit

- Foundations in Financial Management

- Foundation in Taxation

Further, a candidate must complete the following:

- Professionalism and Ethics Module

- One (1) year relevant practical experience

Chartered Certified Accountant

Full-fledged member

An individual who have completed the qualification and become a Member is entitled to use the post-nominal letters ACCA (Associated Chartered Certified Accountant).

Diploma in Accounting and Business

(DAB)

This diploma, with UK RQF Level 4, is awarded upon completion of the Applied Knowledge exams comprising of three parts — Business and Technology; Financial Accounting; and Management Accounting — which gives you a broad understanding of essential accounting techniques.

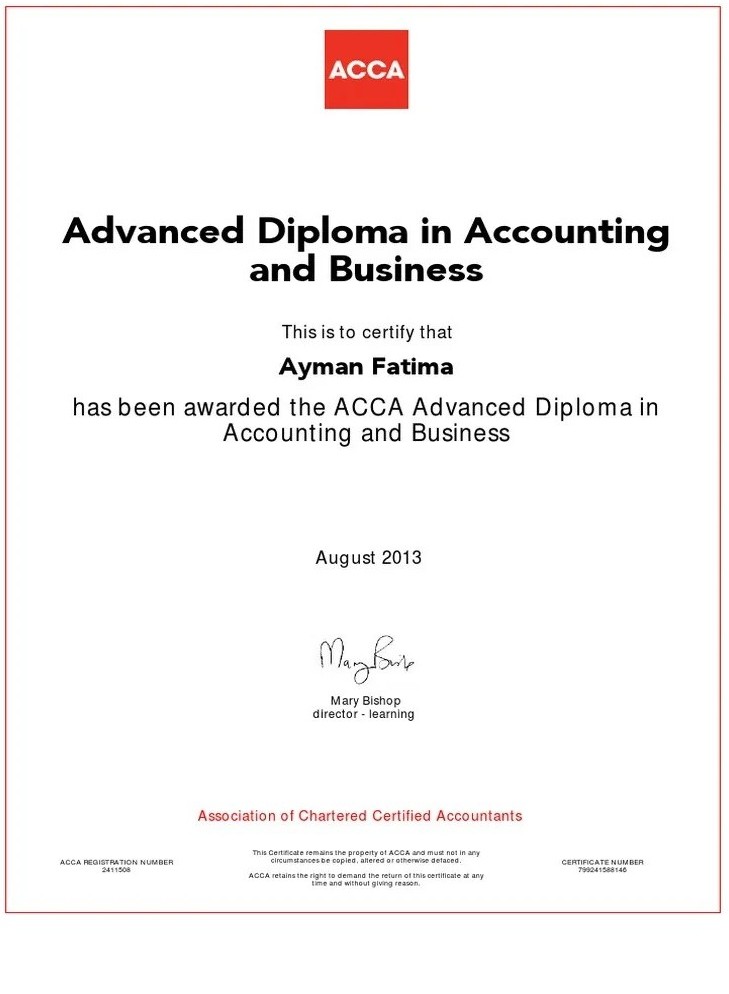

Advanced Diploma in Accounting and Business

(ADAB)

This diploma is awarded upon completion of the Applied Skills exams of six modules — Taxation; Performance Management; Audit and Assurance; Corporate and Business Law; Financial Reporting; and Financial

Management — plus the Ethics and Professional Skills module.

This diploma is benchmarked at a UK Bachelor’s university degree.

Strategic Professional Modules

These modules were designed to develop the technical expertise, ethics and professional skills you need to make an impact in the workplace. Every element of the Strategic Professional level has real-world focus.

Includes two (2) Essential modules comprising of:

- Strategic Business Leader (SBL), and

- Strategic Business Reporting (SBR);

and two(2) Options modules — which is an opportunity to specialize in an area that’s relevant to your career goals:

- Advanced Financial Management (AFM),

- Advanced Performance Management (APM),

- Advanced Taxation (ATX), and

- Advanced Audit and Assurance (AAA)

Fellow Chartered Certified Accountant

An ACCA after at least five (5) years of membership may be eligible to become a Fellow Chartered Certified Accountant.

UK University Academic Degrees

On top of the ACCA qualifications, a learner may also opt to earn the following degrees:

BSc (Hons) Degree in Applied Accounting

Oxford Brookes University, UK

This degree may be earned by learners who have completed the Applied Knowledge and Applied Skills exams.

Learners who opt to earn the BSc (Hons) Degree in Applied Accounting must submit and Pass the Research and Analysis Project (RAP).

*The deadline for completion of requirements for the BSc program is until May 2026 with extension up to Nov 2026 for those who fail the RAP in May 2026.

MSc in Professional Accountancy

University of London, UK

The MSc in Professional Accountancy is designed for career-minded finance professionals who wish to complement their professional skills with master’s level understanding and skills, applied to accountancy and finance subject areas.

This means that as well as having a professional qualification from the world’s most forward thinking accountancy body, you could also have a postgraduate qualification from the University of London, one of the world’s top ten universities.